FAQs • Sales Tax & Tax Exemption

Frequently Asked Questions Regarding Sales Tax & Tax Exemption on Orders from Johnny's

Johnny's Selected Seeds is required to charge sales tax on orders shipping to a number of states where Johnny's is required by law to collect state tax, unless the customer is a tax-exempt organization or a reseller with a current exemption certificate on file with Johnny's.

Please refer to these FAQs for information regarding sales tax charges and exemptions on Johnny's orders, and Contact Us should you require further assistance.

Why are you collecting sales tax?

For many years Johnny's collected sales tax only in Maine, where we are located. With a June 2018 Supreme Court ruling (South Dakota v. Wayfair, Inc., Overstock.com, Inc., and Newegg, Inc.), a change was made to the state sales tax obligations for all companies selling remotely through websites and catalogs. As a result of the decision, Johnny's must collect and remit sales tax in all states that require tax remittance.

Do you tax all products? How is tax calculated?

Johnny's charges sales tax on orders for taxable items in accordance with applicable state and local tax laws. The amount of sales tax charged depends on several factors, including the item purchased, the destination of the order, and the location from which your order is shipped. Please be advised that the estimated sales tax may differ from the final amount charged for your order.

Why is the sales tax "estimated" on my web order?

For online orders, the sales tax is estimated for all items. The remittance of sale tax is finalized through our internal order fulfillment process, at which time your order will be adjusted to reflect a final sales tax charge for your shipping location.

What is a sales tax exemption certificate?

A sales tax exemption certificate is a document that enables a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate on file so the purchaser can make purchases without being charged sales tax.

What qualifies one for an exemption certificate?

Each state charging sales tax maintains an agency responsible for administrating its sales tax system. The agency or tax authority issues exemptions to qualified businesses. For more information about exemption requirements please reference your State Department of Revenue service.

What is a resale certificate/seller's permit?

A resale certificate is a form utilized by businesses that purchase goods that they intend to resell. This form is also referred to as an exemption certificate in some states. It is a written statement that the business will not be using the goods for personal use before reselling them. It is also used when purchasing goods for this purpose. Using this permit, you will not be subjected to sales tax. You will be asked for this certificate as proof when you purchase products from Johnny's.

Where can I obtain an exemption certificate?

For more information about exemption requirements, please reference your State Department of Revenue service online website.

How do I send in my exemption certificate?

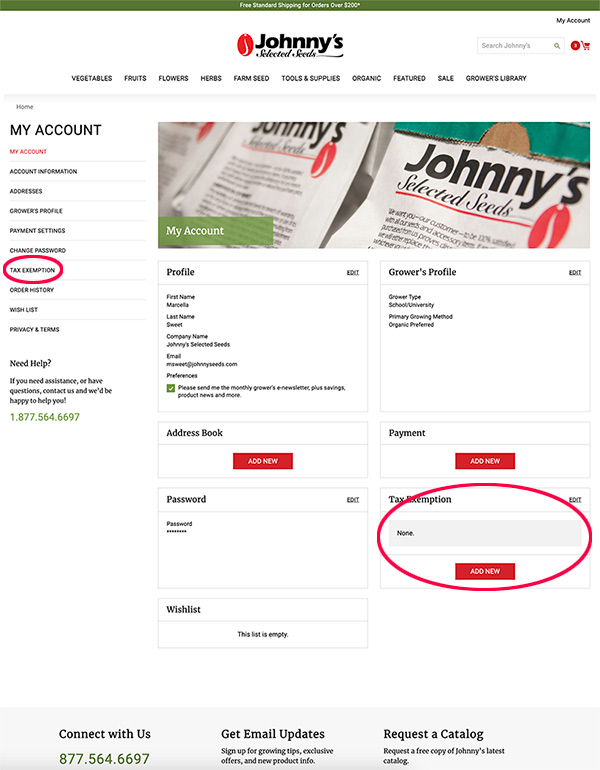

Many of our customers qualify for tax exemption. If your purchases qualify for exemption, we're here to help you. If you have tax exempt status and have a current certificate or reseller permit, provide us with a copy for our records. You can submit your certificate through our easy and secure online form by selecting the "Submit New Certificate" button on the Tax Exemption page within My Account. Other ways to submit your certificate include:

Fax: 800-738-6314

Mail: PO Box 299

Waterville ME 04901

ATTN: Accounting Exemption Certificates

Email: [email protected]

I submitted my tax exemption certificate online. When will I be able to apply it to my order?

Once your certificate is submitted, it is reviewed by the Johnny's finance department within 48 hours. If all the appropriate information is submitted, the certificate is approved and associated with your Johnny's account. This allows future purchases via any order channel including phone or the website, to automatically apply the exemption when using your account.

I need to apply my tax exemption certificate to a current order. Can I expedite the approval process?

If you plan to complete an order in less than 48 hours that will require your tax exemption certificate, please call our Customer Care department for assistance at 1-877-564-6697

What is Avalara CertExpress?

Avalara CertExpress is a secure and reputable tool that helps us collect and manage tax exemption certificates. The online form is customized based on your exemption location and allows you to quickly upload your tax exemption certificate or manually fill in the form information.

How will my tax exemption certificate be applied to my online order?

To ensure your tax exemption status is applied to your online order, you must checkout using a registered online account and have a tax exemption certificate on file with Johnny's. If these two factors are met, the taxes associated with your online purchase will be waived where applicable.

How do I know if I have a tax exemption certificate on file with Johnny's?

If you have a registered online account, you can view a list of your tax exemption certificates under Tax Exemption in the My Account section of the website.

Please note that you must Log In in order to view the My Account section.

You can also Contact Us via phone or email for this information.

I live in a shipping location where some agricultural products I'm ordering are naturally tax-exempt. Why am I seeing sales tax being applied to those items while I'm checking out?

For online orders, the sales tax is estimated for all items, including the items that may be tax-exempt in your shipping location. Once your order is finalized through our internal order fulfillment process, the final tax amount will be adjusted to reflect only the taxable items for your shipping location.

The above information should not be considered sales tax advice; please contact your State Department of Revenue service for further guidance.

Call Us Toll-Free at

January–April

Mon–Fri: 8am–8pm ETSat–Sun: 8am–5pm ET

May

Mon–Fri: 8am–7pm ETJune–December

Mon–Fri: 8am–5pm ETNOTE: Seasonal hours subject to change.